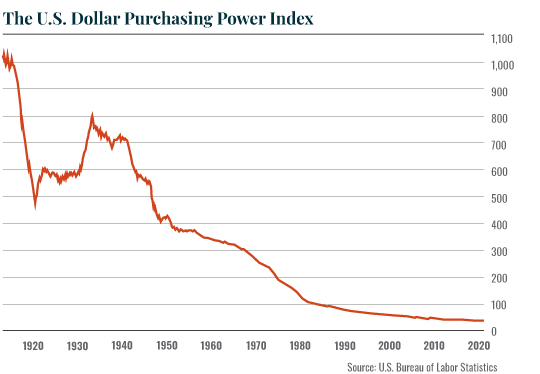

| Purchasing power is the proverbial “bang for your buck” — how much of something you can buy for a single unit of currency. In the United States, one dollar today is worth only 4% of what it was worth in 1913. (The year the current Federal Reserve was founded.) Below is one of the ugliest charts you’ll ever see. They don’t show this chart in school for good reason.  As you can see, the $USD is one of the worst “assets” to own. Indeed, since 2000 alone it has lost over 38% of its purchasing power! And this is the asset we use to price stocks! An Alternate Perspective So, what happens when we price stocks in gold, an asset that accounts for inflation and which cannot be devalued by a central bank. Buckle up, it’s not pretty.  Yes, you are seeing that correctly. Priced in gold, instead of dollars, the stock market has gone NOWHERE for over 20 years. In fact, stocks are still DOWN 50% from their peak relative to gold in 2000. So this begs the question… Do stocks even MAKE money? I’ll answer that question in tomorrow’s issue. Best Regards,

Graham Summers

Editor, Money & Crisis P.S. The purchasing power of the dollar is an absolute disaster — with no bottom in sight. Unfortunately, like the proverbial frog in the pot of boiling water, most people don’t have a clue about what’s happening to the purchasing power of their “fiat” dollars. Gold has always been one of the best hedges against this kind of devaluation. If you’re interested in adding physical gold to your portfolio, I’d recommend Hard Assets Alliance to do it. They’re one of the best sources for buying, selling and even storing your gold. (Full disclosure, we own a stake in the company.) You can go here to get more information on them and even open an account right online. |

Tidak ada komentar:

Posting Komentar