President Joe Biden is scheduled to present his American Families Plan today — in which he seeks $1.9 trillion to pay for programs designed to support families and children. Among those programs include at least two years of free community college for adults, paid family leave, providing more affordable childcare, and implementing preschool as a standard in education. To pay for all this, Biden's plan is explicit in ending Trump-era tax breaks and increasing taxes on the wealthy. In a statement released by the White House this morning, the administration remarked: Alongside the American Families Plan, the President will be proposing a set of measures to make sure that the wealthiest Americans pay their share in taxes, while ensuring that no one making $400,000 per year or less will see their taxes go up.

Let's unpack this a little... First, I think it's important to note the proposal clearly creates an obvious imposed moral dilemma. You can't argue against programs designed to help families and children without political or social backlash. Arguing against these types of programs is how you get "canceled." | | The #1 Gold Stock of the Decade This firm is potentially sitting on the richest undeveloped gold mine on Earth. It trades for around $4 a share right now. But soon it could be trading for $40 or more. Click here for details. |

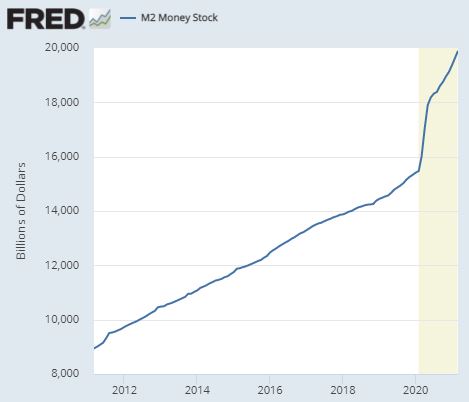

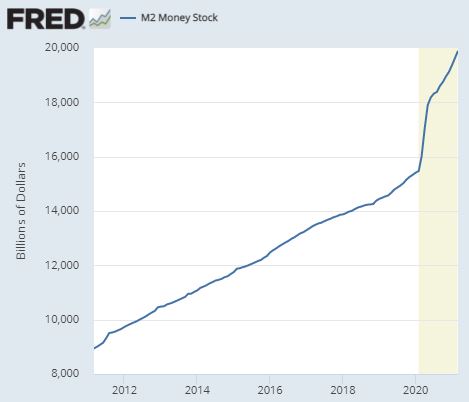

So right off the bat, we must consider how Congress' decisions can be actively influenced using social pressure, resulting in at least a semi-forced choice, and whether that is a way of conducting politics that is wholly acceptable — especially in the American Families Plan. The conservative media will no doubt be asking why it's appropriate to raise taxes on the rich — either by ending tax breaks or directly increasing tax rates — to pay for Biden's American Families Plan. But the more important question they should be asking is why it's appropriate for anyone to be taxed to pay for the plan. Spoiler alert: It's not. The combined price tag of COVID-19 stimulus bills approved by Congress was already over $4 trillion. None of those stimulus bills required taxes to be raised on anyone. So why do taxes need to be raised now to pay for another one? They don't. To pay for the stimulus bills already approved by Congress, the country undertook a program of monetizing debt, whereby the government creates new debt out of thin air that is purchased by the Federal Reserve with freshly minted money. In other words, to pay for those stimulus bills, the government just created the money. And boy did it create a lot of it. Over the past 12 months, the supply of U.S. dollars has increased by more than 25%.

So why not just continue to print new money in order to pay for Biden's American Families Plan? | | 25X Bigger Than “Standard” 5G The biggest 5G story has nothing to do with smartphones or faster internet. It’s about a once-in-a-century infrastructure upgrade that’s crucial for our national defense, vital emergency services, critical infrastructure, and economy. Trump kicked it off with Executive Order 13920 back in May 2020 and even the Democrats are behind it... That’s why investors who get in now stand to reap a windfall of profits before 2021 ends. This is an extremely time-sensitive opportunity because this small, hidden gem in the massive 5G rollout could become a buyout target as soon as tomorrow. For the full story (for free), click here. |

Inflation? Every step of the way, the Federal Reserve has downplayed the inflationary effects of monetizing debt to pay for COVID-19 recovery. At its last meeting in March, the Fed upgraded its forecast that core inflation would rise to 2.4% this year, but then pull back to 2.1% by 2023. The Fed's long-term target for inflation is only 2%. Later today, Chairman Jerome Powell will announce the minutes from the FOMC meeting. And again, it's likely Powell will downplay future inflationary consequences from the fiscal and monetary response to the COVID-19 pandemic. So the Federal Reserve is telling us that inflation won't be too much of a problem, even after adding 25% to the money supply. Can the Biden administration really say that printing up another $1.9 trillion in new money would be just enough to put inflationary pressures over the top? Definitely not. Here's what I think is really going on... Biden's motivation behind the American Families Plan is all (or mostly) political. A significant part of the liberal spectrum that makes up Biden's base maintains an anti-rich sentiment. And taxing the wealthy delights those Biden supporters who are in that part of the spectrum. Playing Robin Hood is good PR for Biden. At the end of the day, Biden's proposal for the American Families Plan really has little to nothing to do with programs designed to support families and children. Instead, it seems to be mostly a proposal to roll back a lot of tax breaks Trump made for the rich, end some tax loopholes, and hike taxes on the wealthiest Americans. And, IMO, that would be a fine proposal. I'd much prefer to see Biden take direct action in seeking tax increases on the rich. I'd be fine with a "Raise Taxes on the Rich" plan. I might not end up agreeing with the plan, but hiding behind the "families and children" banner to get the job done is cheap. I had some glimmer of hope that Biden wasn't just going to continue to serve up a bunch of BS like the last administration. Yet, here we are. Until next time,

Luke Burgess

The Beginning of the End for Bitcoin Starts June 16 President Biden is going to rock the financial system to its core. His first target? Bitcoin. It won’t happen overnight. It will be gradual, but those who prepare sooner rather than later could turn every $1,000 into as much as an extraordinary $94,840… And this ban wouldn’t be the first time something like this happened either. In 1933, FDR placed a ban on citizens owning gold and forced them to turn in their yellow metal. The coming financial “regulations” could have an even greater impact than the gold confiscation. While most are scrambling to get in on the Bitcoin hype before it ends, I’ve uncovered an opportunity that will only grow during these uncertain times. And it doesn’t involve owning a single cryptocurrency… I’ve put together a free presentation for you that goes over all the details of this opportunity. Click here to learn how savvy investors could turn a modest $1,000 in to as much as an extraordinary $94,840 or more! |

|

Tidak ada komentar:

Posting Komentar