Dear Money & Crisis Reader, Dear Money & Crisis Reader,

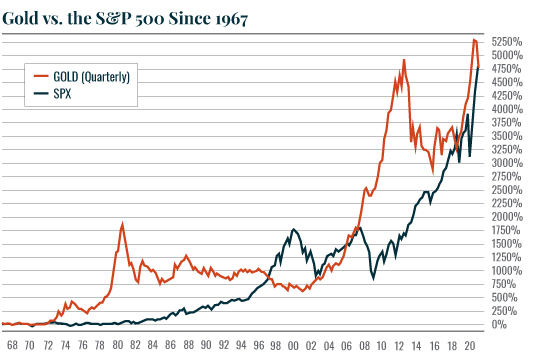

Yesterday we assessed gold as a long-term investment. As a brief recap, gold is a TERRIFIC long-term investment as the chart below shows. It tracks the precious metal’s performance relative to stocks since 1967 — when gold was no longer pegged to currencies.

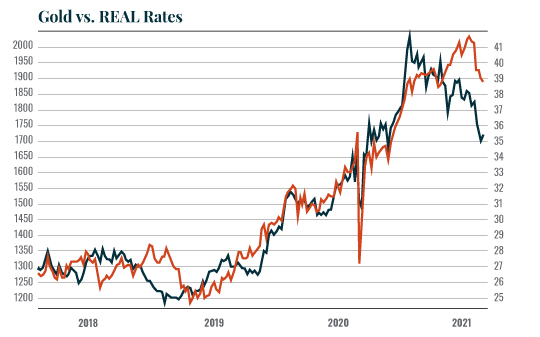

Today we’re going to assess gold as a near-term trade based on inflation. Gold is indeed an inflationary hedge. And with inflation on the rise, gold should do very well — eventually. I say eventually because in the near-term, gold primarily trades based on real rates. Real rates are the inflation-adjusted return you’d make by lending your money to the U.S. government. To do this, you need to subtract what you’d earn from owning Treasury Inflation-Protected Securities (TIPS) from what you would earn from owning normal Treasuries. Doing this provides you with what’s referred to as “real rates” or the REAL (inflation-based) return you get from owning an asset. (I’ve previously talked about the TIPS/Treasury ratio as an indicator of screaming inflation…) You can see the close relationship between gold and real rates in the chart below:

Two Factors When It Comes to Gold and Inflation With this in mind, the key for buying gold based on inflation hinges on two things: - 1) What real rates are doing.

- 2) What the $USD is doing.

Regarding the first point, real rates are currently stabilizing after a recent correction. Until we see real rates break out of this consolidation to the upside in a BIG way, then gold will continue to experience some downward pressure.

Unfortunately, the U.S. Dollar isn’t helping the situation either… |

Tidak ada komentar:

Posting Komentar