There's a prevailing trend among many Wall Street analysts to dismiss inflation. They tend to talk about it like it's ancient lore — something not seen since the 1970s. Case in point: One opinion writer for The Washington Post recently wrote, "Remember inflation? If you, like most Americans, were born after 1981, the answer must be 'no.'" Honestly, what an absurd thing to say. I was born in 1983, and believe me, I'm plenty familiar with inflation. | Get Behind This $1.5 Billion DARPA Project The Defense Department’s research wing, DARPA, just teamed up with one off-radar company... Their goal? To save the future of computing. Without this innovation it’ll be impossible to scale artificial intelligence, 5G, and the internet of things... Institutional investors like Vanguard and BlackRock are pouring billions into this company as we speak. Now you have the chance to get on board with them. Everyday Americans could set themselves up for 950%... 6,893%... or even an incredible 12,795% gain. But a huge announcement could be made as soon as tomorrow... causing the stock to skyrocket. That’s why you must act now. | What cost $10 back then costs $26 now. But that doesn't even come close to telling the whole story. That's because the "headline" numbers or the oft-cited consumer price index flat-out ignore the cost of our most basic needs — things like food, shelter, health care, education, and energy. Those are some pretty important things. In fact, they account for the overwhelming majority of Americans' spending habits. So look at college tuition. Back in 1981 college tuition, including room and board, cost about $3,500 per year. Today, it's $35,000 — or closer to $20,000 if you stick to an in-state school. That's many multitudes more than the headline inflation rate.

Again, that's something millennials like me are plenty familiar with. Now, let's take a look at home prices...

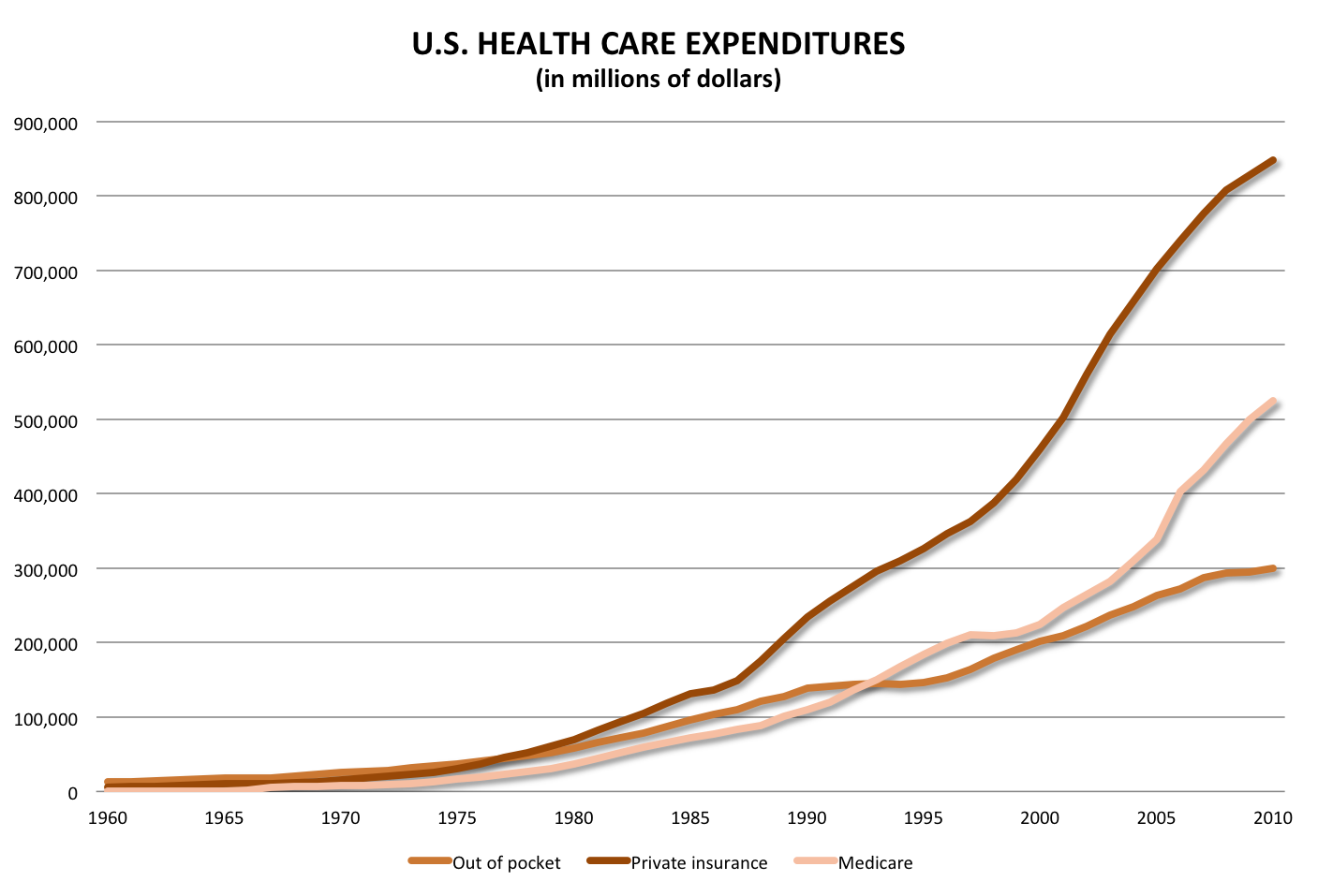

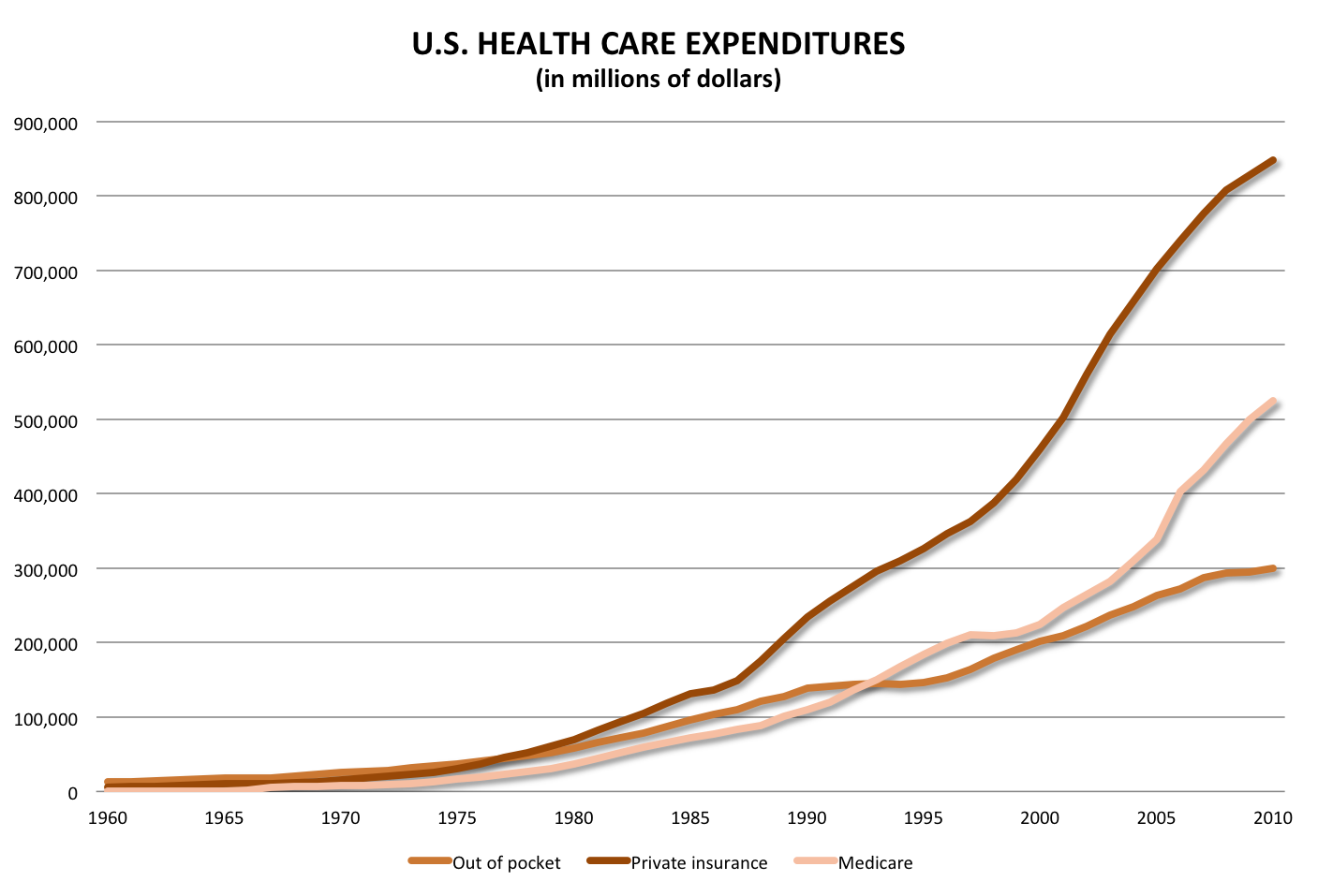

Does that look like inflation to you? It does to me. | Apple’s Ultimate Masterpiece About to Hit the Market Folks, Apple has been running the personal technology game for decades. Every single gadget it's ever released has been a smash hit. And now, it's ready to release what could be its final product. Its magnum opus. One product that could replace every single device you own. And best of all, it could make you unbelievably rich. And as if that’s not enough — you don’t have to buy a single share of Apple’s stock to do it. Click here to find out what Apple’s planning... | Aside from the 2008 collapse, home prices have moved steadily higher these past few decades. And in fact, they've been particularly hot of late. Home prices rose 10.4% in 2020, their fastest pace in seven years. And last week, the National Association of Realtors reported that the median existing-home sale price rose 14.1% in January to $303,900. That's a 341% increase from 1981, when the median home price was $68,900. Food prices have been heading higher too. Supermarket prices were 3.7% higher in January than they were a year ago. Prices for poultry, seafood, and dairy products increased between 4.4% (dairy products and other meats) and 9.6% (beef and veal), according to the USDA. Looking ahead to this year, 2021 is expected to see wholesale pork prices rise 2%–5%, farm-level soybean prices rise 28.5%–31.5%, wholesale fats and oil prices rise 6%–9%, farm-level wheat prices rise 6.5%–9.5%, and wholesale wheat flour prices rise 4%–7%. How about another basic necessity, healthcare costs?

Is that not inflation? | 20-Cent Tech Stock Stops COVID-19 Outbreaks BEFORE They Happen Big Pharma is in a $100 billion race to roll out vaccines... But one tiny tech stock just beat them all to the punch, marking an end to COVID-19. It owns 100 patents on an instant COVID-detecting technology that stops outbreaks BEFORE they happen. Which is why it’s rolling out everywhere. As the Washington Post reports, “In the weeks to come, this will be not only at airports and arenas but workplaces, schools, housing complexes and anywhere else Americans gather en masse.” The company behind this only trades for $0.20, but that won’t last much longer... Click here for the full story. | Everywhere we look, prices have soared in both the short and long term. Yet I'm supposed to believe inflation is merely a figment of my imagination. Or rather, that it simply doesn't count because the price of "durable goods" like washing machines is what's truly important. Well, that's absurd. And it's a dangerous way to think — not so much for economists pontificating on the pages of Forbes or The Washington Post, but for the chairman of the Federal Reserve. “The economy is a long way from our employment and inflation goals, and it is likely to take some time for substantial further progress to be achieved,” Jerome Powell said this week. Powell also said it "could take more than three years" for inflation to hit the Fed's desired levels. That's three more years of double-digit increases in food prices. Three more years of soaring home prices (great if you're an owner — tough luck if you're not). And three more years of rising education. So don't be fooled by inflation denialists — economists, analysts, even the chairman of the Fed — because you're going to be paying out of your ass for things for years to come. We all are. Fight on,

Jason Simpkins  @OCSimpkins on Twitter @OCSimpkins on Twitter

Jason Simpkins is Assistant Managing Editor of the Outsider Club and Investment Director of The Wealth Warrior, a financial advisory focused on security companies and defense contractors. For more on Jason, check out his editor's page. *Follow Outsider Club on Facebook and Twitter. |

Tidak ada komentar:

Posting Komentar